Bank Statements for Mortgage Applications: A Comprehensive Guide

When applying for a mortgage, one of the essential documents you'll need to provide is your bank statement. A bank statement serves as a financial record, showcasing your income, expenses, and overall financial health.

Lenders often scrutinize bank statements to assess your creditworthiness and evaluate your ability to repay the loan. In this article, we will delve into the world of bank statements, specifically focusing on their importance in the mortgage sector. We'll explore different formats, key components, and offer valuable tips to ensure your bank statements are in optimal shape for a successful mortgage application.

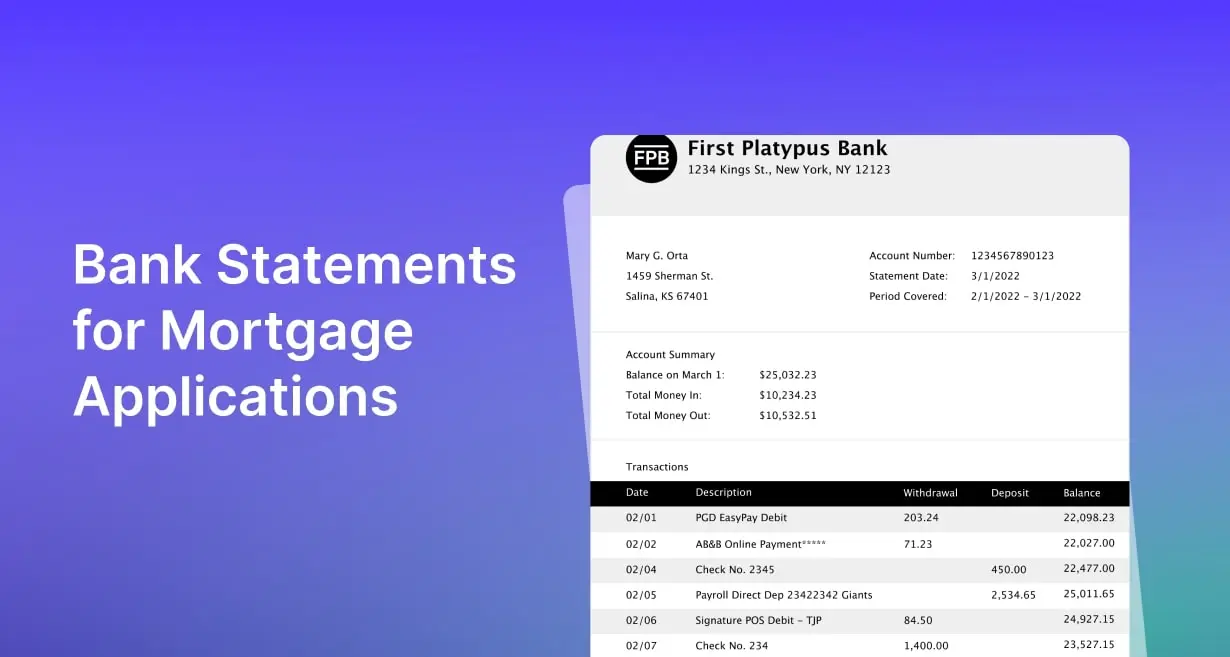

What is a Bank Statement?

A bank statement is a document provided by your financial institution, typically on a monthly basis, summarizing the transactions and activities within your bank account. It provides a detailed record of your deposits, withdrawals, and account balances over a specific period. Bank statements are usually accessible in both electronic and paper formats, allowing individuals to choose their preferred method of review.

Why are Bank Statements Important?

Bank statements play a crucial role in the mortgage application process. They offer lenders a comprehensive understanding of your financial situation and help evaluate your creditworthiness. By analyzing your bank statements, lenders can assess your income, expenses, and overall financial stability. This information enables them to make an informed decision regarding your mortgage application and determine the loan amount you qualify for.

Bank Statements for Mortgage Applications

When applying for a mortgage, your bank statements provide evidence of your financial capabilities. Lenders review these statements to verify your income, assess your debt-to-income ratio, and evaluate your spending habits. Bank statements also serve as a valuable tool for detecting any potential red flags, such as irregularities or signs of financial instability.

Understanding Bank Statement Formats

Bank statements are available in two primary formats: electronic and paper. Let's explore the characteristics of each format:

Electronic Bank Statements

Electronic bank statements, also known as e-statements, are digital copies of your bank records. They are typically accessible through your online banking portal or can be delivered via email. Electronic statements offer several advantages, including convenience, accessibility, and reduced paper clutter. They are often provided in PDF format, making them easily downloadable and printable, if required.

Paper Bank Statements

Paper bank statements are physical documents provided by your financial institution. These statements are typically mailed to your registered address or can be collected from the bank branch. While paper statements may seem less convenient in today's digital age, they still hold relevance for some individuals who prefer tangible records or may face constraints accessing electronic statements.

Key Components of a Bank Statement

Bank statements consist of various sections and components that provide valuable financial information. Familiarize yourself with these key components to better understand your bank statement:

Account Information

This section includes your account number, account holder's name, and contact details. It serves as identification and ensures that the statement is linked to the correct account.

Transaction Details

The transaction details section provides a comprehensive list of all the transactions made during the statement period. It includes details such as the date of the transaction, transaction description, and the amount involved. This section helps you track your spending and identify any irregularities or unauthorized transactions.

Balance Summary

The balance summary section provides an overview of your account's opening balance, closing balance, and any interest earned or charges incurred during the statement period. It helps you understand your financial position and track changes in your account balance over time.

Other Important Sections

Bank statements may also include additional sections, such as a summary of fees and charges, ATM withdrawals, direct deposits, or any other relevant information specific to your account. These sections contribute to the overall understanding of your financial activities.

Tips for Preparing Bank Statements for Mortgage Applications

Preparing your bank statements for a mortgage application requires careful attention to detail. Follow these tips to ensure your bank statements present your financial profile in the best possible light:

Review Your Statements Regularly

Make it a habit to review your bank statements regularly. This practice helps you stay informed about your financial activities, identify any errors or discrepancies, and ensure the accuracy of the information presented. Regular reviews also enable you to address any potential issues before they affect your mortgage application.

Keep Track of Deposits and Withdrawals

Maintain a clear record of your deposits and withdrawals. This record helps you identify the sources of your income, including salary, bonuses, or rental payments. Lenders often look for a consistent pattern of income, so it's important to provide clear documentation and explanations for any large or irregular deposits.

Avoid Large Cash Deposits

Large cash deposits can raise concerns for lenders, as they are difficult to trace and verify. If possible, try to minimize cash deposits before applying for a mortgage. If you do have significant cash deposits, be prepared to provide adequate documentation and explanations to reassure the lender of the source and legitimacy of the funds.

Maintain a Consistent Pattern of Income and Expenses

Consistency in your income and expenses is crucial for mortgage applications. Lenders analyze your bank statements to assess your ability to manage your finances and meet your monthly obligations. Demonstrating a consistent pattern of income and expenses reassures lenders that you can handle the financial responsibility associated with a mortgage.

Common Challenges with Bank Statements and How to Address Them

While bank statements are an essential part of the mortgage application process, they can present certain challenges. Here are some common challenges and tips to address them effectively:

Incomplete or Missing Statements

Sometimes, individuals may not receive complete statements for a specific period or may misplace them. To overcome this challenge, reach out to your financial institution and request the missing statements. Most banks maintain digital records and can provide you with the necessary documentation.

Discrepancies or Errors on Statements

It's important to review your bank statements thoroughly for any discrepancies or errors. If you identify any inaccuracies, contact your bank immediately to rectify the issue. Lenders rely on accurate information, and any discrepancies can raise concerns during the mortgage application process.

Multiple Bank Accounts

If you have multiple bank accounts, gather statements for all the relevant accounts. Lenders often require statements from all your accounts to gain a complete understanding of your financial situation. Be diligent in providing statements for all active accounts, even if they are not directly related to your mortgage application.

Benefits of Providing Accurate Bank Statements

Providing accurate and well-prepared bank statements offers several benefits during the mortgage application process. Let's explore some of these advantages:

Strengthening Mortgage Applications

Accurate bank statements provide lenders with a clear picture of your financial health, demonstrating your ability to manage your finances responsibly. This strengthens your mortgage application and increases your chances of loan approval.

Demonstrating Financial Responsibility

Bank statements act as evidence of your financial responsibility and stability. They show lenders that you can manage your income, expenses, and debts effectively. By presenting accurate bank statements, you reinforce your reputation as a reliable borrower.

Facilitating Loan Approval Process

Well-prepared bank statements streamline the loan approval process. Lenders can quickly assess your financial position, verify your income, and evaluate your eligibility for the mortgage. Accurate statements save time for both you and the lender, expediting the application process.

Frequently Asked Questions

What is a bank statement?

A bank statement is a document provided by your financial institution that summarizes the transactions and activities within your bank account over a specific period.

Why do I need a bank statement for a mortgage application?

Lenders require bank statements for mortgage applications to assess your financial health, verify your income, evaluate your spending habits, and determine your creditworthiness.

How often should I review my bank statements?

It is advisable to review your bank statements regularly, preferably on a monthly basis. This helps you stay informed about your financial activities and ensures the accuracy of the information presented.

What should I look for when reviewing my bank statements for a mortgage application?

When reviewing your bank statements for a mortgage application, pay attention to your income sources, expenses, account balances, and any irregularities or errors. Lenders analyze this information to evaluate your financial stability.

Can I use electronic bank statements for my mortgage application?

Yes, electronic bank statements are widely accepted for mortgage applications. They are often available in PDF format through your online banking portal and can be easily downloaded, printed, and provided to the lender.

How can I address discrepancies or errors on my bank statements?

If you identify any discrepancies or errors on your bank statements, contact your bank immediately to rectify the issue. It is important to provide accurate and reliable information to lenders during the mortgage application process.

Do I need to provide bank statements for all my accounts?

It depends on the requirements of your lender. In many cases, you will need to provide bank statements for all your active accounts, including checking, savings, and investment accounts, to give lenders a comprehensive view of your financial situation.

What if I have large cash deposits in my bank statements?

Large cash deposits can raise concerns for lenders as they are difficult to trace and verify. It is recommended to minimize cash deposits before applying for a mortgage. If you have significant cash deposits, be prepared to provide documentation and explanations to reassure the lender about the source and legitimacy of the funds.

Are bank statements the only documents required for a mortgage application?

No, bank statements are just one of the many documents required for a mortgage application. Other documents may include pay stubs, tax returns, employment verification, and proof of assets. It is best to consult with your lender or mortgage advisor to determine the specific documents needed for your application.

Conclusion

Bank statements are vital documents in the mortgage sector, providing lenders with valuable insights into your financial situation. By understanding the importance of bank statements, familiarizing yourself with their formats and components, and following best practices for preparation, you can optimize your chances of a successful mortgage application. Remember, accuracy, consistency, and transparency are key when it comes to presenting your bank statements. Stay proactive in managing your finances and ensure your bank statements reflect your financial health accurately.