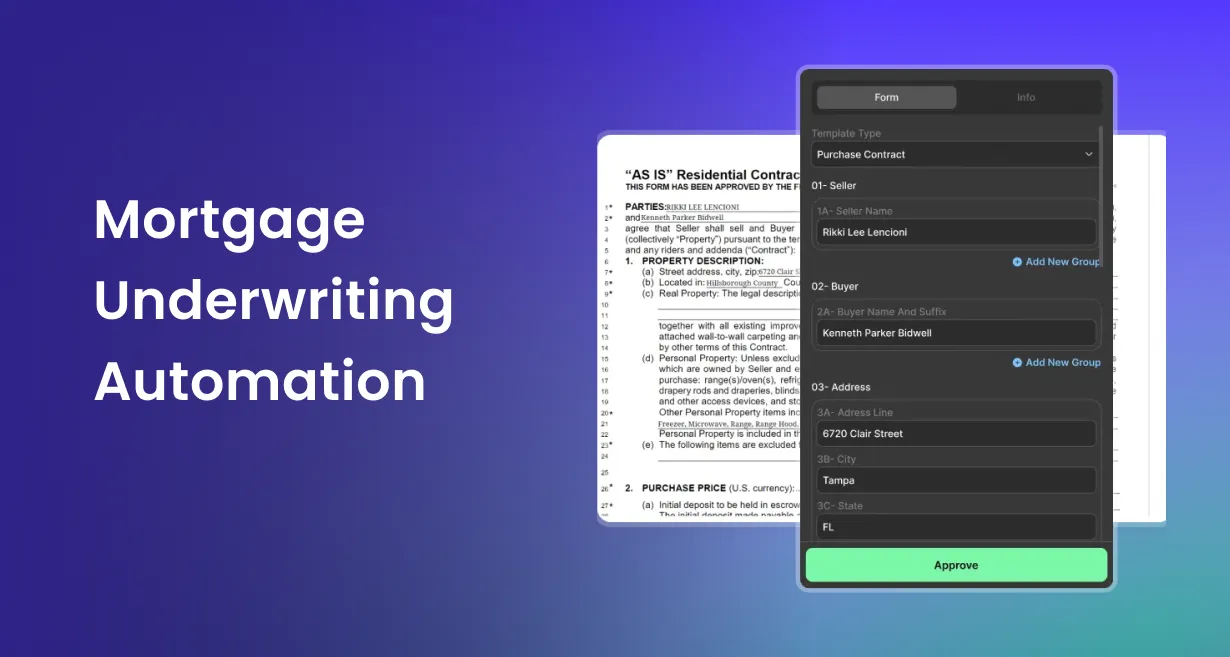

Mortgage Underwriting Automation

The benefits of speed, efficiency, objectivity, and the integration of AI position automated underwriting systems as a cornerstone of modern lending practices.

In the ever-evolving landscape of the financial industry, mortgage underwriting automation software has emerged as a game-changer, streamlining and revolutionizing the traditional lending process. This technological advancement has garnered significant attention due to its efficiency and effectiveness in handling the complexities of mortgage underwriting. In this comprehensive exploration, we delve into what automated underwriting mortgage entails, who benefits from such systems, the distinctions between automation and manual underwriting, the advantages it offers, and the pivotal role of artificial intelligence (AI) in this transformative process.

What is Mortgage Underwriting Automation?

Mortgage underwriting automation refers to the use of advanced technologies and algorithms to expedite and enhance the mortgage underwriting process. This involves the automated assessment of a borrower's creditworthiness, the property's value, and other crucial factors that influence the loan approval decision. Essentially, the system replaces or augments manual underwriting tasks with sophisticated software solutions designed to analyze data swiftly and accurately.

Automated mortgage underwriting systems utilize cutting-edge technology to assess risk, evaluate financial histories, and determine the suitability of a borrower for a mortgage loan. These systems can process vast amounts of data in a fraction of the time it would take a human underwriter, thereby significantly reducing the time it takes to approve or deny a loan application.

Who Prefers a Mortgage Underwriting Automation System?

Various stakeholders within the mortgage industry find immense value in adopting mortgage automated underwriting systems. Lenders, for instance, are keen on embracing this technology as it allows them to expedite the loan approval process, reduce operational costs, and minimize the risk of human errors associated with manual underwriting. Borrowers, on the other hand, benefit from faster decision-making, leading to quicker access to funds for their home purchases.

Additionally, investors and financial institutions that deal with mortgage-backed securities are attracted to the reliability and consistency offered by automated underwriting systems. The standardized and objective nature of these systems helps instill confidence in investors, making the mortgage market more attractive.

What is the Difference Between Mortgage Underwriting Automation and Manual Mortgage Underwriting?

A fundamental aspect to consider is the distinction between mortgage underwriting automation and its manual counterpart. Manual underwriting relies on human expertise rather than automated mortgage underwriting to meticulously review and analyze each component of a loan application. This process can be time-consuming and is susceptible to the limitations of human capacity, potentially leading to errors or delays.

On the contrary, automated mortgage underwriting software leverages algorithms and data-driven processes to make objective and consistent decisions. These systems can quickly assess large volumes of data, ensuring a thorough evaluation of a borrower's creditworthiness, debt-to-income ratio, and other pertinent factors. The speed and accuracy of automation not only expedite the approval process but also contribute to a more reliable and standardized evaluation.

What Are the Benefits of Mortgage Underwriting Automation?

The adoption of mortgage underwriting automation brings forth a myriad of benefits that resonate across the lending landscape. One of the primary advantages is the expedited loan approval process. Automated systems can assess and process information at a pace far exceeding human capabilities, reducing the time it takes to reach a lending decision.

Moreover, the efficiency gains translate into cost savings for lenders. By automating routine and time-consuming tasks, financial institutions can allocate resources more strategically, focusing human expertise on complex scenarios that may require nuanced decision-making.

The objectivity inherent in automated underwriting systems is another notable benefit. Eliminating human biases and inconsistencies ensures a fair and standardized evaluation of all loan applications. This not only enhances the integrity of the lending process but also fosters trust among borrowers and investors.

Furthermore, the reduction of manual errors contributes to a more robust risk management framework. Mortgage automated underwriting software is designed to minimize the likelihood of oversights or miscalculations, enhancing the overall accuracy of loan assessments. This, in turn, helps lenders mitigate risks associated with loan defaults.

What Is the Role of AI in a Mortgage Underwriting Automation System?

At the heart of mortgage underwriting automation is the integration of artificial intelligence (AI). AI plays a pivotal role in enhancing the capabilities of automated systems, enabling them to learn from vast datasets and adapt to evolving market dynamics.

The application of AI in mortgage underwriting involves machine learning algorithms that can analyze historical data to identify patterns and trends. This empowers the system to make predictions and decisions based on a deep understanding of complex financial scenarios. The self-learning nature of AI ensures continuous improvement, allowing the system to evolve and adapt to changing risk factors and market conditions.

AI also contributes to the customization of underwriting processes. By leveraging AI-driven insights, lenders can tailor their approach based on individual borrower profiles, creating a more personalized and responsive lending experience. This level of customization enhances customer satisfaction and strengthens the lender-borrower relationship.

In conclusion, mortgage underwriting automation stands as a transformative force in the financial industry, redefining how loans are evaluated and approved. As technology continues to advance, the synergy between automation and artificial intelligence will likely drive further innovations, shaping the future of mortgage underwriting.