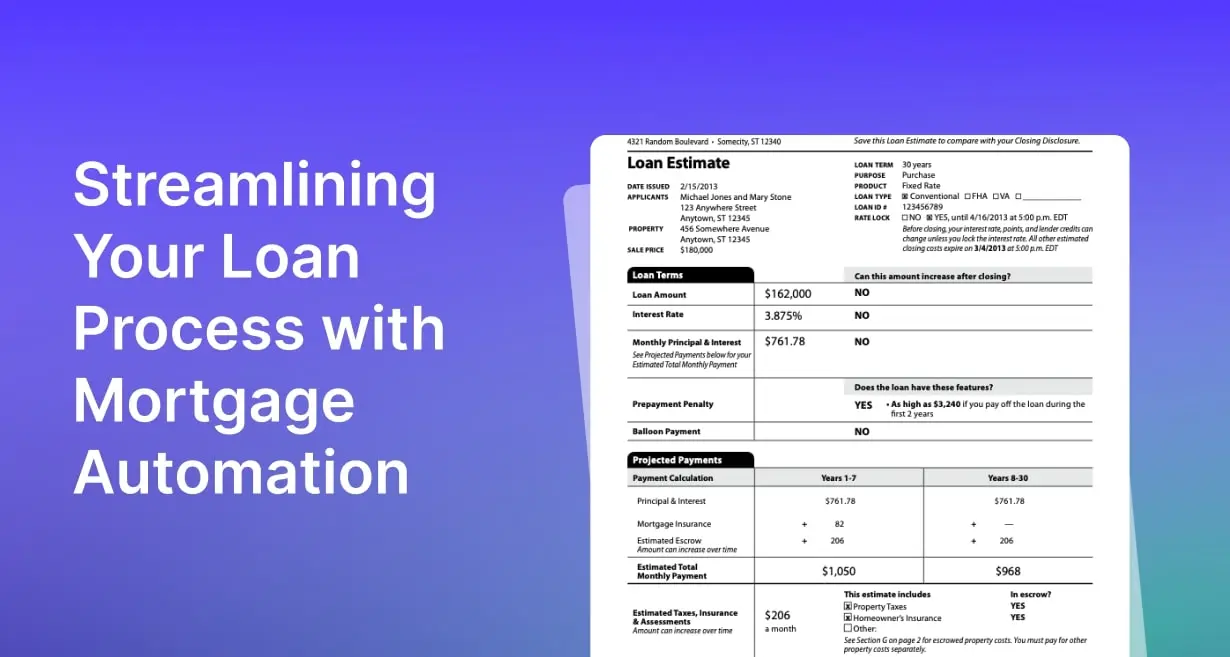

Streamlining Your Loan Process with Mortgage Automation

In today's digital age, automation has revolutionized various industries, and the mortgage industry is no exception. Mortgage automation refers to the use of technology and advanced algorithms to streamline and optimize the mortgage process, from application to closing.

This article explores the concept of mortgage automation, its benefits, the role of technology, best practices for implementation, challenges to overcome, and the future of this rapidly evolving field.

What is Mortgage Automation?

Mortgage automation is the application of technology-driven solutions to automate and digitize various stages of the mortgage process. It involves leveraging advanced algorithms, artificial intelligence, and robotic process automation to eliminate manual tasks, reduce paperwork, and improve overall efficiency. By automating repetitive and time-consuming processes, such as document collection, verification, and underwriting, mortgage automation enables lenders to expedite loan approvals, enhance customer experience, and reduce operational costs.

The Benefits of Mortgage Automation

Streamlined Application Process

One of the primary advantages of mortgage automation is the ability to streamline the application process. Traditionally, mortgage applications involve numerous forms, mortgage documents, and manual data entry, which can be cumbersome and prone to errors. With automation, borrowers can complete applications online, and data can be automatically populated and validated, minimizing errors and speeding up the overall process. Additionally, automation enables real-time status updates and notifications, keeping borrowers informed and engaged throughout the application journey.

Improved Accuracy and Efficiency

By automating data collection and analysis, mortgage automation improves accuracy and efficiency in several ways. Advanced algorithms can verify and validate borrower information, income, and credit scores, ensuring compliance with lending regulations. Automation also eliminates redundant steps and reduces manual intervention, minimizing the risk of human error. With streamlined processes and faster turnaround times, lenders can serve more customers and allocate resources more effectively.

Enhanced Customer Experience

Mortgage automation enhances the customer experience by providing a more convenient and transparent process. Borrowers can complete applications from the comfort of their homes, at any time, and easily track the progress of their applications. Automated systems can provide personalized recommendations and insights, helping borrowers make more informed decisions. With quick approvals and reduced paperwork, customers experience a smoother and more efficient journey, leading to increased satisfaction and loyalty.

The Role of Technology in Mortgage Automation

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) play a crucial role in mortgage automation. These technologies enable systems to learn from vast amounts of data, identify patterns, and make intelligent decisions. AI-powered algorithms can analyze borrower profiles, credit histories, bank statements and financial data to determine eligibility and risk. ML algorithms can continuously improve accuracy by adapting to changing market conditions and evolving lending criteria. By leveraging AI and ML, mortgage automation systems can make faster and more accurate underwriting decisions, reducing manual effort and expediting loan approvals.

Robotic Process Automation

Robotic process automation (RPA) automates repetitive and rule-based tasks in the mortgage process. RPA bots can extract data from various sources, populate forms, perform calculations, and validate information. This technology eliminates manual data entry, reducing errors and saving valuable time. RPA also facilitates seamless integration between different systems and applications, allowing data to flow smoothly throughout the mortgage lifecycle. With RPA, lenders can achieve end-to-end automation, from application intake to post-closing activities.

Data Analytics and Predictive Modeling

Data analytics and predictive modeling enable lenders to make data-driven decisions and optimize their mortgage operations. By analyzing historical data, lenders can identify patterns, trends, and risk factors, improving loan pricing and risk assessment. Predictive models can forecast borrower behavior, identify potential defaults, and enable proactive risk management. With access to actionable insights, lenders can refine their lending strategies, improve portfolio performance, and deliver personalized experiences to borrowers.

Implementing Mortgage Automation: Best Practices

Selecting the Right Mortgage Automation Platform

Choosing the right mortgage automation platform is a critical step in successful implementation. Lenders should consider factors such as scalability, flexibility, integration capabilities, and vendor reputation. The platform should align with the lender's specific needs and support the desired automation goals. It's essential to evaluate the platform's user interface, functionality, and reporting capabilities to ensure a seamless user experience and efficient workflow.

Integrating Systems and Data

To achieve end-to-end automation, it's crucial to integrate various systems and data sources. The mortgage automation platform should seamlessly connect with loan origination systems, credit bureaus, income verification providers, and other relevant databases. This integration ensures data accuracy, eliminates duplicate entry, and enhances process efficiency. Lenders should work closely with their technology partners to design and implement robust integration strategies.

Ensuring Compliance and Security

Compliance and security are paramount in the mortgage industry. When implementing automation, lenders must ensure that the system adheres to regulatory requirements and data privacy standards. The platform should have robust security measures in place to protect sensitive borrower information. Regular audits and monitoring should be conducted to identify and address any potential vulnerabilities. Compliance should be an integral part of the automation strategy from the outset.

Training and Adoption

Successful mortgage automation relies on proper training and adoption by the lender's staff. Training programs should be designed to familiarize employees with the new processes, tools, and functionalities. Lenders should provide ongoing support and resources to address any challenges or questions that arise during the transition. Encouraging employee engagement and involvement in the automation journey fosters a culture of innovation and continuous improvement.

Overcoming Challenges in Mortgage Automation

Change Management

Implementing mortgage automation often requires a significant cultural and organizational shift. Change management strategies should be employed to address resistance to change and ensure smooth adoption. Open communication, stakeholder engagement, and clear communication of the benefits of automation are essential to gain buy-in from employees at all levels.

Legacy Systems and Infrastructure

Legacy systems and outdated infrastructure can pose challenges in implementing mortgage automation. Incompatibility issues and data migration complexities may arise when integrating new technology with existing systems. Lenders should assess their current IT landscape and invest in necessary upgrades or system replacements to enable seamless automation.

Data Quality and Integrity

Data quality and integrity are critical factors in the success of mortgage automation. Inaccurate or incomplete data can lead to erroneous decisions and process bottlenecks. Lenders should establish data governance frameworks and implement data validation mechanisms to ensure data accuracy and consistency. Regular data audits and quality checks should be performed to maintain data integrity throughout the automation journey.

Regulatory and Legal Considerations

The mortgage industry is subject to various regulatory and legal requirements. Lenders must ensure that their automation processes comply with relevant laws, regulations, and industry guidelines. Compliance teams should be involved from the outset to assess the impact of automation on regulatory obligations. It's crucial to work closely with legal counsel to navigate any legal complexities and mitigate potential risks.

The Future of Mortgage Automation

Intelligent Automation and Personalization

The future of mortgage automation lies in intelligent automation and personalization. Advanced AI algorithms will enable systems to provide tailored recommendations and customized experiences for borrowers. Automation will not only streamline processes but also enable lenders to better understand borrower preferences and needs, leading to improved customer satisfaction and loyalty.

Blockchain and Smart Contracts

Blockchain technology holds immense potential in the mortgage industry. Smart contracts can automate and streamline contract execution, eliminating the need for intermediaries and reducing the risk of fraud. Blockchain-based systems can provide transparent and secure transactions, ensuring the integrity of property records and improving the efficiency of the closing process.

Voice and Chatbot Technology

Voice and chatbot technologies are transforming customer interactions in the mortgage industry. Conversational interfaces powered by natural language processing enable borrowers to engage with automated systems using voice commands or text-based chat. Chatbots can provide instant responses to common queries, guide borrowers through the application process, and offer personalized assistance, enhancing the overall customer experience.

Frequently Asked Questions

What is mortgage automation?

Mortgage automation refers to the use of technology and advanced algorithms to automate and digitize various stages of the mortgage process, streamlining and optimizing the application, underwriting, and closing processes.

What are the benefits of mortgage automation?

Mortgage automation offers several benefits, including a streamlined application process, improved accuracy and efficiency, enhanced customer experience, faster loan approvals, reduced paperwork, and lower operational costs.

How does mortgage automation use technology?

Mortgage automation utilizes technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and data analytics to automate data collection, verification, underwriting, and decision-making processes.

Can mortgage automation improve the customer experience?

Yes, mortgage automation enhances the customer experience by providing a convenient and transparent process. Borrowers can complete applications online, track their progress in real-time, and receive personalized recommendations, leading to increased satisfaction and engagement.

Is mortgage automation secure and compliant?

Yes, mortgage automation prioritizes security and compliance. Robust security measures are in place to protect borrower information, and automation systems are designed to comply with regulatory requirements and data privacy standards.

How can mortgage automation help lenders improve efficiency?

Mortgage automation reduces manual effort and eliminates redundant tasks, allowing lenders to process applications faster, allocate resources more effectively, and improve overall operational efficiency.

What challenges are associated with mortgage automation?

Challenges in mortgage automation include change management, integrating legacy systems, ensuring data quality and integrity, and navigating regulatory and legal considerations. These challenges can be overcome with proper planning, training, and collaboration with technology and compliance experts.

What is the future of mortgage automation?

The future of mortgage automation involves intelligent automation, personalized experiences, blockchain technology for secure transactions, and the use of voice and chatbot technology for seamless customer interactions. These advancements will further enhance efficiency and customer satisfaction in the mortgage industry.

Conclusion

Mortgage automation has emerged as a game-changer in the mortgage industry, offering numerous benefits to lenders and borrowers alike. By leveraging technology, such as AI, RPA, and data analytics, lenders can streamline the application process, improve accuracy and efficiency, and deliver exceptional customer experiences. Successful implementation requires careful consideration of the right automation platform, integration of systems and data, compliance with regulatory requirements, and proper training and adoption. While challenges exist, the future of mortgage automation looks promising, with intelligent automation, blockchain, and voice/chatbot technologies shaping the industry. As the mortgage industry continues to evolve, embracing automation will be crucial for lenders seeking to stay competitive and meet the ever-changing demands of borrowers in the digital era.