What Do You Need for a Mortgage Loan?

Securing a mortgage loan necessitates careful preparation and gathering of various documents and considerations. Firstly, financial documentation forms the cornerstone of your application.

Lenders will request proof of income, typically in the form of pay stubs, W-2 forms, or tax returns, to verify your ability to repay the loan. A stable employment history strengthens your application, showcasing consistency in income generation. Your creditworthiness plays a pivotal role, with lenders scrutinizing your credit report and score. Maintaining a healthy credit score and manageable debt-to-income ratio enhances your chances of approval and favorable loan terms.

Moreover, a down payment is often required, though the amount varies based on factors such as loan type and lender specifications. Generally, a larger down payment can lower monthly payments and interest rates. Additionally, identification documents such as a driver's license or passport are necessary to verify your identity.

Property-related documents, including appraisals and purchase agreements, also factor into the mortgage process, ensuring the property's value aligns with the loan amount. Understanding these prerequisites and organizing your documentation meticulously streamlines the application process, expediting approval and securing favorable loan terms. By addressing these requirements comprehensively, you embark on your homeownership journey equipped with the necessary tools for mortgage success.

Essential Documents for Your Mortgage Application

When applying for a mortgage, assembling essential documents is crucial for a smooth process. These include proof of income, verifying your financial stability, along with proof of assets and bank statements to showcase your financial health. A gift letter may be necessary if funds are received from a family member or friend. Credit history is paramount, demonstrating your financial responsibility, while employment verification confirms your ability to meet repayments. Identification documents ensure your identity is verified. Collecting these documents diligently ensures a comprehensive mortgage application, increasing the likelihood of approval and securing favorable terms for your home loan.

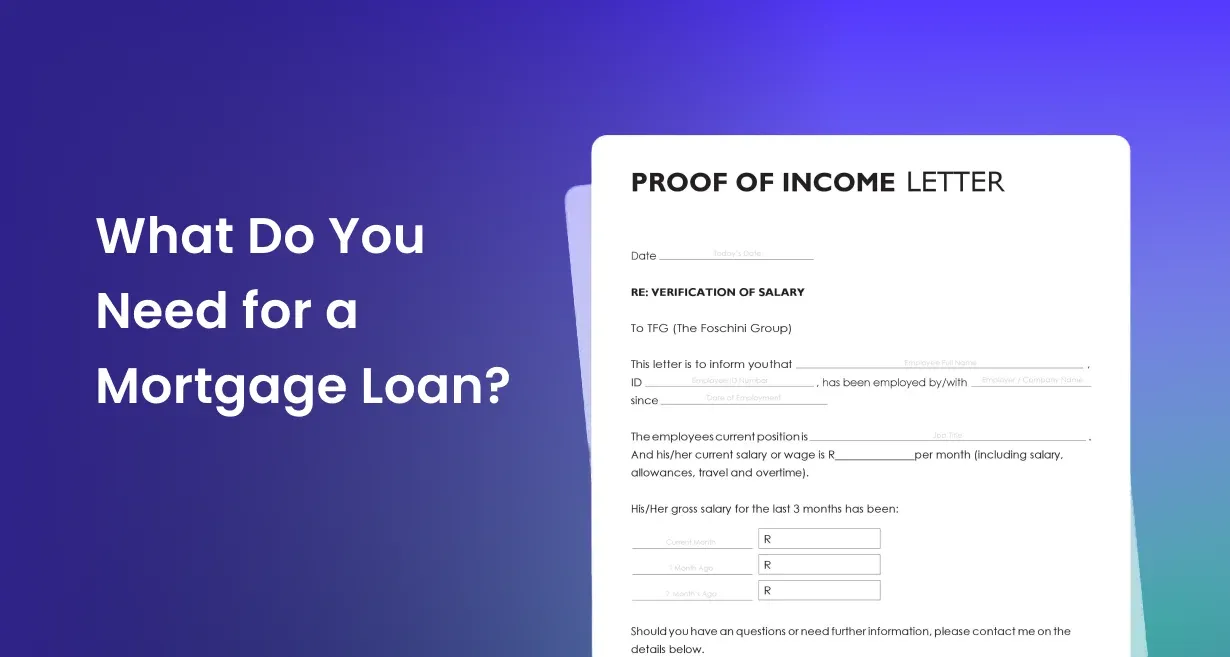

Proof of Income for Mortgage Loan

Proof of income is a critical requirement when applying for a mortgage loan. This documentation validates your ability to repay the loan and is typically provided through pay stubs, W-2 forms, or tax returns. These documents demonstrate a stable income stream, assuring lenders of your financial capability. For self-employed individuals, profit and loss statements or bank statements may be required to verify income. Accurate and consistent proof of income not only strengthens your mortgage application but also helps lenders assess the appropriate loan amount and terms. Ensuring you have the necessary documentation readily available streamlines the mortgage approval process.

Bank Statements

Bank statements are crucial documents when applying for a mortgage loan. They offer a comprehensive view of your financial health, displaying income, expenses, and saving habits. Lenders analyze these statements to verify the source and consistency of your income, assess your debt-to-income ratio, and ensure you have sufficient funds for a down payment and closing costs. Additionally, bank statements help detect any irregularities or red flags that could impact your loan approval. Providing clear and accurate bank statements reinforces your financial credibility and enhances your chances of securing a mortgage with favorable terms.

Gift letters

Gift letters are important documents in mortgage applications, particularly when the down payment or closing costs are funded by a gift from a family member or friend. These letters confirm that the funds provided are a genuine gift and not a loan that needs to be repaid. They typically include the donor's name, relationship to the borrower, the amount gifted, and a statement asserting that no repayment is expected. Lenders require gift letters to ensure transparency and compliance with regulations. Providing a thorough and properly executed gift letter helps streamline the mortgage approval process and ensures a smooth transaction.

Summary: Documents Needed for Mortgage

To secure a mortgage, essential documents are required to assess your financial stability and eligibility. Proof of income, including pay stubs, tax returns, and W-2 forms, demonstrates your ability to repay the loan. Bank statements offer insight into your financial habits and savings. Gift letters are necessary if the down payment or closing costs are funded by a gift. Additionally, providing identification documents and employment verification is crucial. These documents collectively paint a comprehensive picture of your financial health, enhancing your chances of mortgage approval and ensuring a smooth transaction process.