What is a Credit Card Statement & How To Read It?

A credit card statement serves as a comprehensive record of financial transactions conducted using a particular credit card within a specified billing cycle.

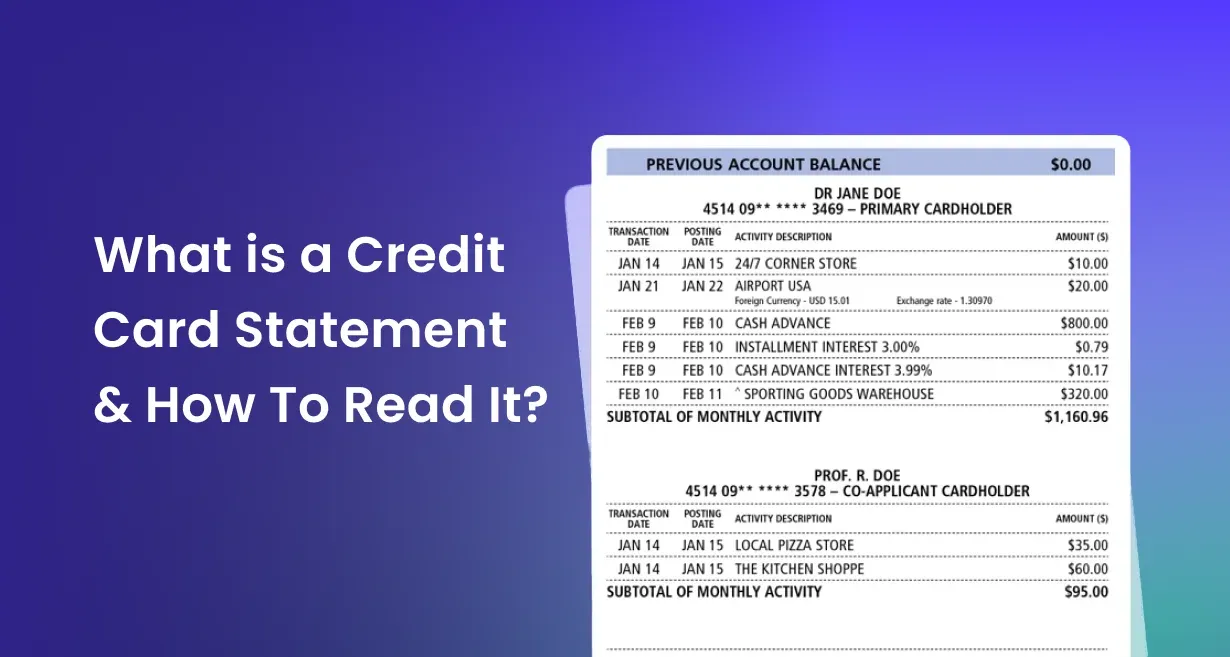

It typically includes details such as transaction dates, merchant names, transaction amounts, fees, interest charges, and the total outstanding balance. Understanding how to read a statement balance credit card is essential for effectively managing personal finances and ensuring financial responsibility.

To read a credit card statement accurately, cardholders need to pay attention to various sections, including transaction details, fees and charges, and the statement balance. Transaction details provide a breakdown of all purchases, payments, and credits made during the billing cycle. Fees and charges highlight any additional costs incurred, such as annual fees, late fees, or interest charges on outstanding balances. The statement balance reflects the total amount owed to the credit card issuer at the end of the billing cycle, including any pending payments or credits.

Analyzing a credit card statement balance enables cardholders to track their spending habits, identify any discrepancies or unauthorized transactions, and plan their financial budget accordingly. By regularly reviewing their credit card statements and understanding how to interpret them accurately, individuals can maintain control over their finances, avoid unnecessary fees, and make informed decisions regarding their spending and repayment strategies.

What is a Credit Card Statement?

A credit card statement is a detailed summary provided by credit card issuers, documenting all financial activities associated with a specific credit card during a designated billing cycle. It encompasses transactions made, payments received, fees incurred, and the outstanding balance owed by the cardholder. This statement serves as a crucial tool for individuals to monitor their spending patterns, assess their financial health, and ensure timely repayments. Understanding the information presented in a credit card statement is vital for effective financial management, enabling cardholders to make informed decisions regarding their finances and maintain control over their credit card usage.

How To Read Credit Card Statement?

Understanding how to read a credit card statement is pivotal for effective financial management. The statement contains critical information, including transaction details, fees, and the statement balance, which reflects the total amount owed. To decipher the statement, start by reviewing the transaction details, which outline purchases, payments, and credits. Next, examine fees such as annual fees or interest charges. The statement balance, often labeled as "current balance" or "amount due," indicates the total amount owed to the credit card issuer. It's crucial to differentiate between the statement balance and the current balance; while the former refers to the total outstanding balance at the end of the billing cycle, the latter encompasses any recent transactions not yet reflected in the statement. Familiarizing yourself with a sample credit card statement can provide clarity and help you navigate future statements confidently. By grasping these key elements, you can effectively manage your credit card finances, track spending, and ensure timely payments to maintain financial stability.

How Do Credit Card Statements Work?

Credit card statements work as comprehensive reports detailing all financial activities conducted using a credit card within a billing cycle. Automation software and tools streamline this process by automatically compiling transaction data, generating statements, and providing insights into spending patterns. These automation solutions enhance efficiency, reduce manual efforts, and ensure accuracy in statement generation. Businesses and individuals benefit from such software, enabling them to track expenses, manage multiple accounts seamlessly, and receive timely notifications for payment due dates. By leveraging credit card statement automation software and tools, users can streamline financial management and make informed decisions regarding their finances.

What is Credit Card Statement Analysis?

Credit card statement analysis involves examining the details provided in a credit card statement to gain insights into one's financial habits and patterns. It encompasses scrutinizing transaction history, categorizing expenses, identifying trends, and evaluating spending behaviors. Through careful analysis, individuals can track their expenditures, assess their budgeting effectiveness, and make informed financial decisions. This process aids in identifying areas for potential cost-saving, detecting any discrepancies or unauthorized charges, and planning for future financial goals. Overall, credit card statement analysis is a valuable tool for managing personal finances effectively and maintaining financial health.

Why is Credit Card Statement automation software preferred?

Credit card statement automation software is favored for its myriad benefits in streamlining financial management processes. These solutions eliminate manual data entry tasks, reducing errors and saving valuable time. By automating statement generation and reconciliation, businesses and individuals can ensure accuracy and efficiency in financial record-keeping. Automated credit card statement tool also offers real-time insights into spending patterns, facilitating better budgeting and decision-making. Moreover, they enhance security by safeguarding sensitive financial information. Overall, the convenience, accuracy, and time-saving aspects make credit card statement automation software a preferred choice for businesses and individuals alike.

Who prefers Credit Card Statement automation software?

Credit card statement automation software is preferred by various entities, including businesses, financial institutions, and individuals seeking efficient financial management solutions. Businesses utilize these tools to streamline accounting processes, ensuring accurate and timely reconciliation of credit card transactions. Financial institutions leverage automation software to enhance customer service by providing detailed and error-free credit card statements. Additionally, individuals who prioritize convenience and accuracy in managing their finances prefer credit card statement automation software. By automating statement generation and reconciliation tasks, users can effectively track expenses, monitor account activity, and ensure timely payments, contributing to better financial health and organization.

What are the benefits of Credit Card Statement automation software?

Credit card statement automation software offers a plethora of benefits for businesses and individuals alike. By automating tedious tasks such as data entry and statement generation, these tools save valuable time and resources. They ensure accuracy in financial records, minimizing errors and discrepancies. Additionally, automation software provides real-time insights into spending patterns, aiding in budgeting and financial planning. Enhanced security features safeguard sensitive financial information, mitigating the risk of fraud or data breaches. Overall, the convenience, efficiency, and accuracy provided by credit card statement automation software make it a valuable asset for businesses and individuals seeking to streamline their financial management processes. The benefits of automated credit card statement generation include time-saving efficiency and enhanced accuracy in financial record-keeping, ensuring seamless management of transactions.