What is a Mortgage Note?

A mortgage note is a legally binding document within a mortgage loan agreement, outlining the borrower's commitment to repay the loan, including terms, interest rate, and repayment schedule.

A mortgage note is a crucial component of a mortgage loan agreement, detailing the borrower's promise to repay the loan. It serves as a legally binding contract, outlining the terms, interest rate, repayment schedule, and consequences of default. Essentially, it's a written pledge of debt, signed by the borrower, acknowledging the amount owed to the lender. Understanding the intricacies of a mortgage note is vital for both borrowers and lenders, as it clarifies their respective obligations and rights throughout the loan term. Thus, comprehending the mortgage note is fundamental for anyone involved in real estate transactions.

Understanding Mortgage Note

Delving into the intricacies of a mortgage note involves comprehending its contents and implications. A mortgage note typically includes vital details such as the loan amount, interest rate, repayment terms, and any penalties for default. For clarity, examining a mortgage note example can elucidate these elements further, providing a tangible illustration of how such documents are structured and what information they contain. By grasping the nuances of mortgage note contents, borrowers and lenders alike can navigate the complexities of real estate transactions with confidence and ensure mutual understanding of their rights and obligations throughout the loan period.

Types of Mortgage Notes

Mortgage notes encompass various types tailored to different financial needs. These include fixed-rate mortgage notes, adjustable-rate mortgage notes, interest-only mortgage notes, and balloon mortgage notes, each offering distinct repayment structures and terms to accommodate diverse borrower preferences and financial circumstances. Understanding the types of mortgage notes is crucial for borrowers and lenders alike, as it determines the specifics of repayment, interest rates, and other essential conditions within the loan agreement.

What Is A Mortgage Promissory Note?

A mortgage promissory note is a legal document that outlines the borrower's promise to repay a loan, including details such as the loan amount, interest rate, repayment terms, and consequences of default, serving as a key component of a mortgage agreement.

Who Holds The Mortgage Note?

The entity or individual holding a mortgage note depends on the nature of the loan and its subsequent handling. Typically, it's held by the lender who originated the loan, but it might be sold to investors or mortgage servicing companies. Understanding the dynamics of holding a mortgage note is crucial for borrowers, as it determines whom they need to make payments to and who has the authority to modify the terms of the loan if necessary, impacting the borrower-lender relationship significantly throughout the loan term.

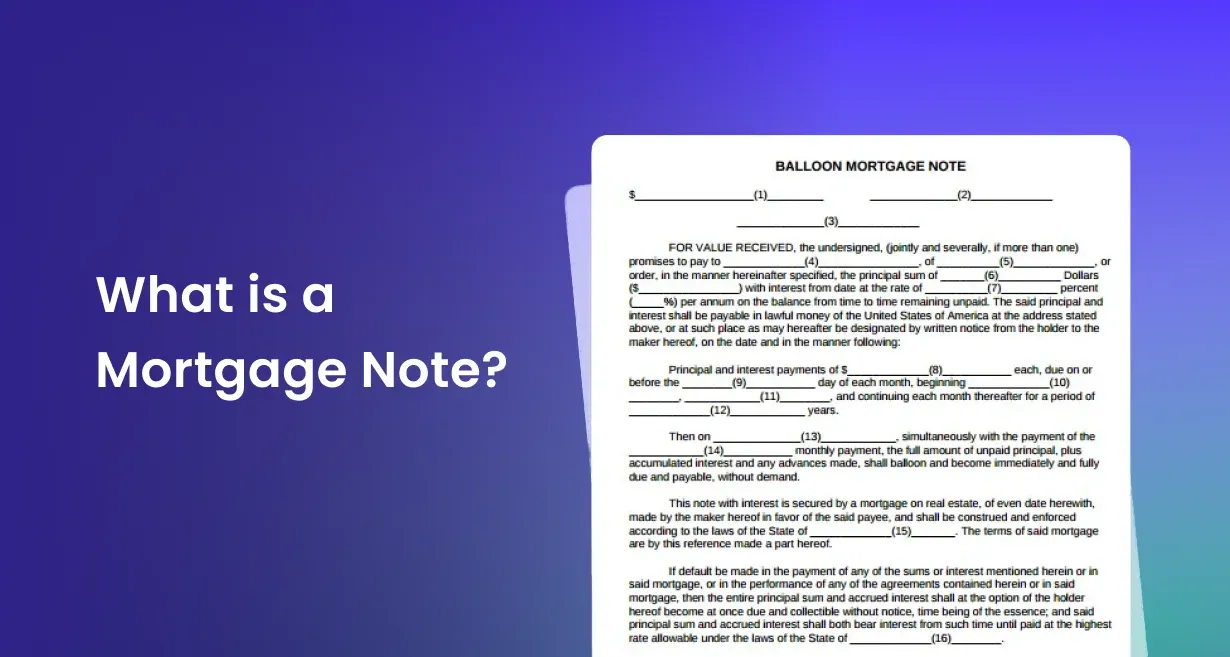

What Does A Mortgage Note Look Like?

A mortgage note typically resembles a formal document, containing essential details such as the borrower and lender's names, the loan amount, interest rate, repayment terms, and any additional clauses or provisions. It often bears signatures of both parties and may include legal language outlining rights and obligations, serving as a tangible representation of the contractual agreement between borrower and lender. Understanding what a mortgage note looks like is crucial for all parties involved in a real estate transaction, ensuring clarity and transparency regarding the terms and conditions of the loan.

What Information Does a Mortgage Note Contain?

A mortgage note typically includes crucial details such as;

- Names of the borrower(s) and lender(s)

- Loan amount

- Interest rate

- Repayment terms (including duration and frequency of payments)

- Description of the property securing the loan

- Late payment penalties or fees

- Prepayment terms (if applicable)

- Default and foreclosure provisions

- Signatures of the borrower(s) and lender(s)

- Date of the note

Frequently Asked Questions about Mortgage Note

This section is a comprehensive resource offering insights into common queries surrounding mortgage notes, aiding borrowers and lenders in understanding their intricacies.

How to Get a Copy of Your Mortgage Note?

Obtaining a copy of your mortgage note involves reaching out to your lender or loan servicer, typically through a formal written request. Ensure to provide necessary identification and loan details, and be prepared to cover any associated fees. Once obtained, carefully review the copy of the mortgage note for accuracy, keeping it in a secure location for future reference. This document serves as a vital record of your loan agreement, offering clarity on terms, conditions, and obligations pertinent to your mortgage.

Is it Possible to Sell a Mortgage Note?

Selling a mortgage note is indeed possible and involves a structured process. Typically, it begins with evaluating the note's value, considering factors like remaining balance, interest rate, and payer's creditworthiness. Once assessed, you can market the note to potential buyers or enlist the services of a note broker. Upon finding a buyer, legal documentation and a purchase agreement are drafted, facilitating the transfer of ownership. Completing due diligence and seeking professional advice can optimize the mortgage note selling process, ensuring fair value and legal compliance.

What is a Mortgage Note Document?

A mortgage note document is a legally binding instrument that outlines the terms of a loan agreement between a borrower and a lender, specifying the loan amount, interest rate, repayment terms, and consequences of default. Understanding the legal implications of mortgage note documents is crucial as they establish the contractual obligations between parties and serve as evidence of the debt owed. Failure to adhere to the terms outlined in the mortgage note document can result in legal actions such as foreclosure or repossession, underscoring the importance of clarity and compliance in real estate transactions.