What is a Mortgage Preapproval?

Mortgage preapproval is a crucial step in the home buying process. Before diving into the real estate market, understanding what mortgage preapproval entails is essential.

Mortgage preapproval is a preliminary assessment conducted by lenders to determine if a borrower qualifies for a mortgage loan. This process involves a thorough review of the borrower's financial background, including income, credit score, and debt-to-income ratio.

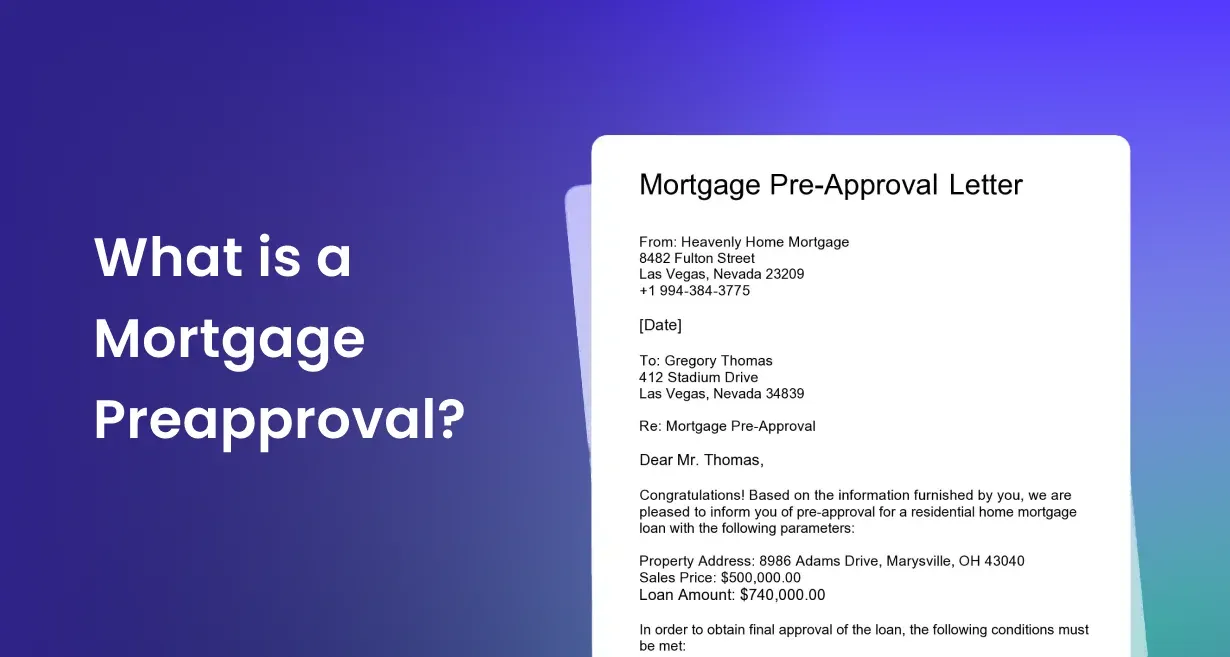

The mortgage preapproval process typically begins with the borrower submitting financial documents to the lender for evaluation. Once reviewed, the lender provides a preapproval letter indicating the maximum loan amount the borrower is eligible for.

The importance of Mortgage Preapproval has several reasons. Firstly, it gives potential homebuyers a clear understanding of their purchasing power, helping them narrow down their property search. Additionally, mortgage preapproval demonstrates to sellers that the buyer is serious and financially capable, potentially giving them an edge in competitive markets. Overall, mortgage preapproval streamlines the home buying process, providing clarity and confidence to both buyers and sellers.

Mortgage automation streamlines the approval process, enhancing efficiency and accuracy. Automated systems analyze financial data, credit history, and property valuation rapidly, reducing manual errors and processing time. By expediting workflows and ensuring consistency, automation optimizes the mortgage approval process, offering borrowers quicker decisions and lenders improved risk management capabilities.

Understanding Mortgage Preapproval

Mortgage preapproval is a critical step in the home buying journey, providing buyers with essential insights into their financial standing. This process involves a thorough assessment by lenders to determine loan eligibility based on factors like income, credit score, and debt-to-income ratio. Mortgage preapproval signifies a lender's willingness to offer a loan up to a specified amount, empowering buyers to make informed decisions while house hunting. It's a key indicator of a buyer's seriousness and financial capability, enhancing their credibility in the eyes of sellers. Understanding the significance of mortgage preapproval is pivotal for navigating the real estate market confidently.

Key Factors Affecting Preapproval Duration

The mortgage preapproval duration hinges on several key factors, influencing the overall process. Firstly, the thoroughness of documentation provided by the borrower significantly impacts the timeline. Completeness and accuracy expedite the assessment. Secondly, the lender's workload and processing efficiency play a pivotal role. High demand periods may lengthen the duration. Thirdly, complexities in the borrower's financial history or property evaluation can extend the process. Additionally, external factors like market fluctuations or regulatory changes might affect mortgage preapproval timelines. Ultimately, proactive preparation, clear communication, and working with a responsive lender can help streamline the mortgage preapproval process, ensuring a smoother experience for prospective homebuyers.

How Long Does A Mortgage Preapproval Last?

The duration of a preapproval for a mortgage lasts depending on several factors. Typically, preapprovals are valid for around 60 to 90 days, but this can differ among lenders. The validity period is primarily determined by changes in the borrower's financial situation, such as employment status, income, or credit score. Additionally, fluctuations in interest rates and market conditions may influence the duration. It's essential for borrowers to inquire about the specific validity period with their lender and to provide updated financial information if needed to extend the preapproval for the mortgage. Understanding the timeframe of a mortgage preapproval ensures that prospective homebuyers can effectively plan their house-hunting journey without encountering unexpected obstacles.

Frequently Asked Questions about Mortgage Preapproval Duration

Wondering about the duration of mortgage preapproval? Typically, it lasts 60 to 90 days, but specifics vary. Changes in financial status and market conditions affect validity. It's crucial to consult your lender for accurate information and updates.

How long should I wait before applying for a mortgage after getting preapproved?

Once preapproved, it's wise to wait until you've found a suitable property. This prevents multiple credit inquiries, which can affect your credit score. Typically, preapprovals last 60 to 90 days, but it's advisable to check with your lender for specific timelines. Applying too soon after preapproval may require reevaluation of your financial status.

Can the validity of a mortgage preapproval vary by lender?

Yes, the validity of a mortgage preapproval can differ among lenders. While the standard duration is typically 60 to 90 days, some lenders may offer shorter or longer periods. It's essential to inquire about the specific validity period when obtaining a preapproval to ensure it aligns with your homebuying timeline.

Can you extend a mortgage pre-approval?

Yes, you can often extend a mortgage pre-approval, but it depends on the lender's policies and your financial circumstances. If your pre-approval is nearing expiration and you haven't found a suitable property, contact your lender. They may require updated financial information or documentation to extend the pre-approval duration.