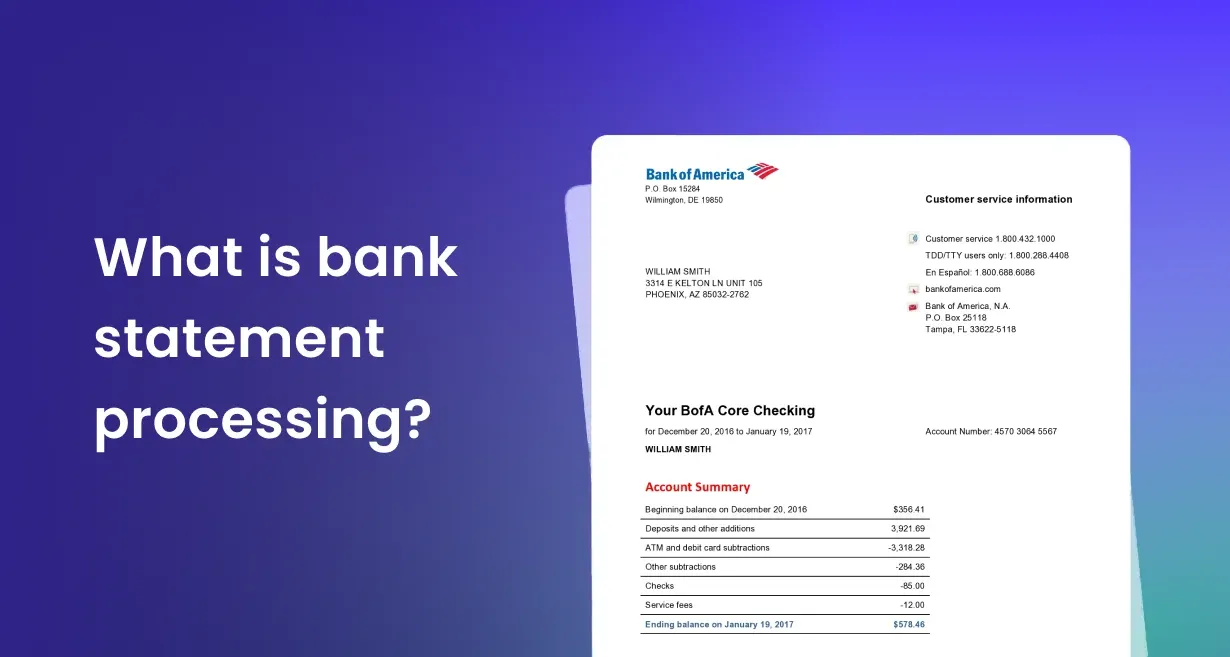

What is bank statement processing? How To?

Bank statement processing is the systematic and automated handling of financial data present in bank statements, a critical aspect of managing personal and business finances.

Many individuals and companies opt for bank statement processing services provided by specialized companies. These services streamline the extraction, organization, and analysis of information from bank statements, saving time and ensuring accuracy.

Bank statement processing involves the extraction of key details such as transaction amounts, dates, and descriptions from statements. Automated tools play a crucial role in this process, efficiently converting the data into a format that is easily understandable and usable. These services cater to the diverse needs of businesses and individuals, providing customized solutions for different financial requirements.

Bank statement processing companies utilize advanced technologies to enhance efficiency and reduce errors. The extracted data is often subjected to bank statement analysis, a further step that involves reviewing spending patterns, identifying trends, and gaining insights into financial behavior. This analysis aids in budgeting, financial planning, and decision-making.

Overall, bank statement processing is a pivotal function for maintaining financial transparency and making informed choices. Utilizing specialized services ensures that the complexities of dealing with bank statements are managed effectively, allowing individuals and businesses to focus on strategic financial goals.

What is bank statement processing?

Bank statement processing involves the systematic handling and analysis of financial data within bank statements. This essential task encompasses the extraction, organization, and interpretation of transaction details, amounts, and dates from these statements. Automated tools are often employed to streamline this process, saving time and minimizing errors. Many individuals and businesses opt for specialized bank statement processing services provided by companies to ensure efficient data management. This practice contributes to financial transparency, aiding in budgeting, planning, and decision-making by offering a comprehensive overview of one's monetary activities.

How to process bank statement?

To process a bank statement, begin by obtaining the statement from the bank, either in physical or digital form. Use automated tools or software to extract transaction details such as dates, amounts, and descriptions. Organize this information systematically for a clear overview. Verify the accuracy of the processed data against the original statement. Automated services or financial software can assist in reconciling balances and identifying discrepancies. Additionally, categorize transactions for a more detailed analysis of spending patterns. Regularly reviewing and updating this processed information ensures accurate financial records, supporting informed decision-making and effective financial management.

Why is the bank statement processed?

Bank statements are processed to gain a clear understanding of financial transactions, ensuring accuracy and transparency in monetary activities. Processing involves extracting vital details like transaction dates, amounts, and descriptions, aiding in organized record-keeping. Verification against the original statement helps identify errors or discrepancies. The data is often categorized for a more nuanced analysis of spending patterns, contributing to effective budgeting and financial planning. Regular processing is essential for maintaining up-to-date and accurate financial records, facilitating informed decision-making. Overall, the purpose of processing a bank statement is to empower individuals and businesses with a comprehensive overview of their financial health and activities.

What are the benefits of bank statement processing?

Bank statement processing provides valuable advantages, especially through automation. This streamlined approach saves time by efficiently extracting and organizing transaction details. The accuracy achieved through processing enhances financial transparency, offering a concise summary of transactions, balances, and expenditure patterns. Categorizing data allows for a thorough analysis, facilitating informed decision-making in budgeting and financial planning. Regular processing serves as a vigilant practice, promptly identifying and rectifying errors or discrepancies to maintain the integrity of financial records.

Moreover, the convenience of automated tools or services simplifies the overall management of financial data. It not only ensures accuracy but also empowers individuals and businesses with a comprehensive understanding of their financial health. Ultimately, the benefits of bank statement processing encompass efficiency, accuracy, transparency, and the ability to make strategic financial decisions confidently.