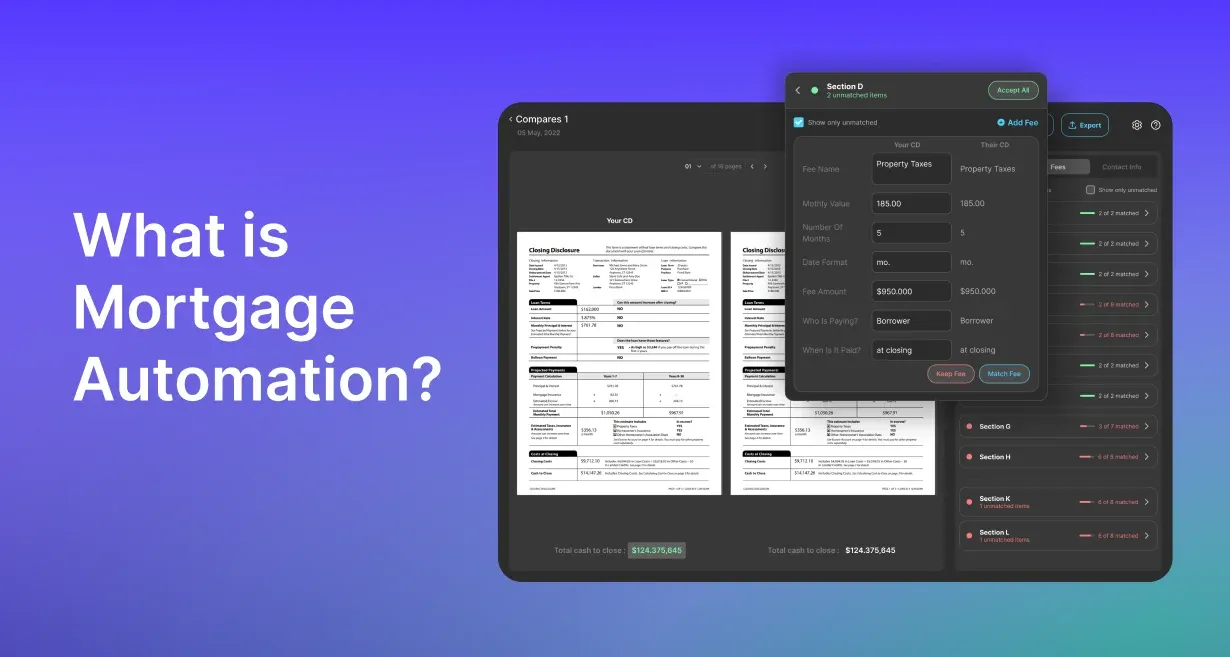

What is Mortgage Automation?

Mortgage automation stands at the forefront of transformative forces within the financial industry, reshaping the traditional landscape of how mortgage processes are managed and executed.

This article will provide an in-depth exploration of mortgage automation, covering its definition, the role of automation in mortgages, the functionalities of mortgage automation software, the step-by-step process of mortgage automation, the associated benefits, and the significance of mortgage document automation tools such as AREAL.AI.

What is the Role of Automation in Mortgages?

Automation has become a cornerstone in modernizing the mortgage industry. Its primary role is to streamline and optimize the complex processes involved in mortgage transactions. By leveraging technology, automation aims to reduce manual intervention, enhance accuracy, and expedite the overall mortgage process.

In the traditional mortgage landscape, the application and approval process can be cumbersome, involving extensive paperwork, manual verifications, and prolonged decision-making timelines. Automation addresses these challenges by introducing efficiency, speed, and a reduction in human errors.

What Does Mortgage Automation Software Do?

Mortgage automation software serves as a comprehensive tool designed to manage and streamline various aspects of the mortgage lifecycle. Its functionalities extend across multiple stages of the mortgage process, offering solutions to challenges that have long plagued the industry.

One of the key features of mortgage automation software is document management. It facilitates the seamless organization, verification, and storage of documents submitted by borrowers. This not only reduces the risk of errors but also ensures compliance with regulatory requirements.

Additionally, automation software plays a crucial role in communication facilitation. It enables efficient and secure communication between various stakeholders, including borrowers, lenders, and third-party service providers. This real-time communication enhances collaboration and transparency throughout the mortgage process.

Workflow optimization is another critical aspect of mortgage automation software. By automating repetitive tasks and decision-making processes, the software contributes to increased operational efficiency. Automated underwriting systems, for example, assess borrower eligibility based on predefined criteria, significantly expediting the approval process.

How Does the Mortgage Automation Process Work?

Understanding the intricacies of how the mortgage automation process operates is crucial for appreciating its impact on efficiency and accuracy. Let's delve into the inner workings of mortgage automation:

The process kicks off with borrowers submitting their mortgage applications. Whether through dedicated software or online platforms, the goal is to make this step accessible and user-friendly. Automation begins at this stage, with digital forms simplifying data collection and minimizing errors associated with manual entry.

Upon receiving the application, mortgage automation tools come into play to verify the authenticity of submitted documents. Leveraging Optical Character Recognition (OCR) technology, these tools extract relevant information, reducing the risk of errors linked to manual data entry. This phase is foundational for establishing a reliable and accurate foundation for the mortgage process.

Automated underwriting systems take center stage in this phase, evaluating the borrower's financial profile against predefined criteria. By automating underwriting, lenders can expedite decision-making while maintaining objectivity and consistency. This critical stage determines the borrower's eligibility and the terms of the mortgage.

Once successfully navigating the underwriting process, the system automates the generation of essential documentation. This includes loan agreements, closing documents, and other paperwork required to finalize the mortgage. Automation at this stage contributes to a smoother, standardized, and transparent closing experience for all involved parties.

Mortgage automation doesn't conclude with the closing of the deal. Post-closing, the system continues to play a significant role. This includes tasks such as record-keeping, compliance monitoring, and ongoing management of the mortgage. Automation ensures that the mortgage remains in good standing and complies with regulatory requirements over time.

Throughout the entire process, mortgage automation involves the seamless integration of data from various sources. Automated systems consolidate information from applications, documents, and external databases. This integrated data serves as the foundation for analytics, providing lenders with insights into trends, risks, and opportunities.

One of the strengths of mortgage automation is its adaptability. Systems are designed to learn and improve over time. Machine learning algorithms, for example, can analyze past transactions and user interactions to enhance decision-making processes and identify areas for further automation.

Automation extends to communication with borrowers. Systems can send automated updates on the status of applications, document requirements, and key milestones. This not only keeps borrowers informed but also contributes to a transparent and efficient communication process.

Automation tools often include features that ensure compliance with ever-evolving regulatory standards. By automating compliance checks and documentation processes, lenders reduce the risk of regulatory issues, aligning with industry standards and legal requirements.

Understanding how each of these components interconnects provides a holistic view of the mortgage automation process. Automation doesn't just replace manual tasks; it transforms the entire mortgage journey, introducing efficiency, accuracy, and adaptability.

What are the Stages of the Mortgage Automation Process?

The mortgage automation process encompasses several stages, each crucial for ensuring a seamless and efficient journey from application to closing. Let's explore these stages in detail:

1. Application Submission

Borrowers initiate the process by submitting their mortgage applications. In a technologically advanced landscape, online platforms and dedicated software make this step user-friendly and accessible. The use of digital forms simplifies data collection and minimizes errors associated with manual entry.

2. Document Verification

Upon receiving the application, mortgage automation tools kick in to verify the authenticity of the submitted documents. Optical Character Recognition (OCR) technology is often employed to extract relevant information from documents, reducing the risk of errors linked to manual data entry. This stage is pivotal for laying the groundwork for a reliable and accurate mortgage process.

3. Underwriting

Automated underwriting systems play a key role in this stage, assessing the borrower's financial profile against predefined criteria. By automating the underwriting process, lenders can expedite decision-making while maintaining objectivity and consistency. This is a critical phase where the system determines the borrower's eligibility and the terms of the mortgage.

4. Approval and Closing

Once the underwriting process is successfully navigated, the system automates the generation of essential documentation. This includes loan agreements, closing documents, and other paperwork required to finalize the mortgage. Automation at this stage contributes to a smoother, standardized, and more transparent closing experience for all parties involved.

5. Post-Closing

Mortgage automation doesn't conclude with the closing of the deal. Post-closing, the system continues to play a significant role. This includes tasks such as record-keeping, compliance monitoring, and ongoing management of the mortgage. Automation ensures that the mortgage remains in good standing and complies with regulatory requirements over time.

These stages collectively form a comprehensive framework for the mortgage automation process. The integration of automation at each step contributes to not only efficiency but also accuracy and transparency in the mortgage journey.

What are the Benefits of Mortgage Automation?

Mortgage automation brings forth a plethora of benefits that have a profound impact on the efficiency and effectiveness of the mortgage process.

- Mitigation of Human Errors

Automation significantly reduces the likelihood of errors in document processing and data entry. This, in turn, enhances the accuracy of mortgage transactions, reducing the risk of costly mistakes.

- Improved Efficiency

By automating repetitive and time-consuming tasks, mortgage processes become more streamlined. This leads to faster turnaround times, enabling lenders to provide quicker responses to applicants.

- Quick Action and Decision-Making

Automated systems contribute to prompt responses to mortgage applications. This is particularly crucial in a competitive market where swift decision-making can be a decisive factor for borrowers.

- Enhanced Customer Experience

Automation contributes to a smoother and more transparent mortgage process. Borrowers benefit from a more user-friendly and efficient experience, leading to increased satisfaction and loyalty.

- Regulatory Compliance

Mortgage automation tools often come equipped with features ensuring adherence to regulatory standards. This reduces the risk of compliance issues, providing a safeguard against legal and financial ramifications.

- Cost Savings

While the initial implementation of mortgage automation systems may incur costs, the long-term benefits include significant cost savings. Reduced manual labor, quicker processes, and fewer errors contribute to a more cost-effective mortgage operation.

In the realm of mortgage document automation, specialized tools such as AREAL.AI play a pivotal role. AREAL.AI supports a variety of documents, offering advanced features like pattern recognition, language processing, and data extraction. This ensures that the vast array of documents involved in mortgage transactions, from pay stubs to property deeds, can be efficiently processed and verified.

AREAL.AI, in particular, stands out for its versatility and adaptability to evolving document standards. It supports a wide range of document types, making it a valuable asset in the mortgage automation toolkit.

What is RPA in mortgage?

RPA, or Robotic Process Automation, revolutionizes mortgage operations by automating repetitive tasks. In mortgage processing, RPA streamlines document verification, data entry, and compliance checks, enhancing efficiency and reducing errors. RPA bots handle routine tasks like gathering applicant information and verifying documents, freeing up human resources for more complex decision-making. This technology expedites loan processing times, improving customer satisfaction and lowering operational costs. By leveraging RPA in mortgage processes, lenders can accelerate loan approvals, mitigate risks, and stay competitive in the ever-evolving mortgage industry landscape.

Benefits of Robotic Processing Automation in Mortgage:

Efficiency: RPA streamlines repetitive tasks such as document verification and data entry, reducing processing time and increasing productivity.

Accuracy: By eliminating manual errors, RPA ensures data accuracy in mortgage processing, reducing the risk of compliance issues and costly mistakes.

Cost Savings: Automation reduces operational costs associated with labor and manual processes, leading to significant savings for mortgage lenders.

Enhanced Customer Experience: Faster processing times and fewer errors result in a smoother mortgage application process, improving customer satisfaction.

Scalability: RPA allows mortgage lenders to handle increased loan volumes without the need for additional manpower, enabling scalability in operations.

What is OCR in mortgage?

OCR, or Optical Character Recognition, plays a pivotal role in the mortgage industry by converting scanned documents into editable and searchable text. In mortgage processing, OCR technology extracts essential information from documents like bank statements, pay stubs, and identification cards, automating data entry tasks. By accurately recognizing text and numbers, OCR expedites document processing, reduces manual errors, and improves data accuracy. Lenders utilize OCR in mortgage workflows to streamline document verification, underwriting, and loan origination processes, ultimately enhancing efficiency and customer experience.

What is the digital mortgage process?

The digital mortgage process revolutionizes traditional manual workflows by integrating automation technologies like mortgage process automation. By digitizing every step from application to closing, the digital mortgage process offers numerous advantages over manual methods. Mortgage process automation streamlines document collection, verification, and approval, accelerating the entire lending process. This approach enhances efficiency, reduces errors, and provides a smoother experience for both lenders and borrowers. With digital mortgage solutions, tasks that once required extensive paperwork and manual effort are now completed swiftly and accurately, leading to faster loan approvals and improved customer satisfaction.

Automate Your Mortgage Loan Process

The process emphasizes leveraging Mortgage Process Automation Solutions to streamline operations and Automate Mortgage Workflows. By integrating automation tools, tasks such as application processing and document verification are digitized, enhancing efficiency and accuracy throughout the mortgage process for both lenders and borrowers.

Application Processing: Implement automation to digitize and streamline the application process, allowing borrowers to submit documents electronically and reducing manual data entry.

Document Verification: Utilize automation tools for Optical Character Recognition (OCR) to extract and verify information from scanned documents, ensuring accuracy and compliance.

Underwriting: Automate underwriting processes by analyzing borrower data and creditworthiness, expediting loan approval decisions while maintaining accuracy and compliance.

Closing Procedures: Implement automation to generate and manage closing documents, facilitating a smoother and more efficient closing process for both borrowers and lenders.

Post-Closing Tasks: Utilize automation to handle post-closing tasks such as document storage, loan servicing, and communication with borrowers, ensuring a seamless transition after loan completion.

Conclusion

In the ever-evolving mortgage landscape, the integration of technology has become crucial, giving rise to the adoption of mortgage process automation. This innovative approach revolutionizes various stages of the mortgage journey, from application processing to document verification and approval.

To fully harness the potential of automation, industry participants often seek the expertise of providers offering specialized mortgage automation services. These services encompass a range of solutions designed to automate and expedite tasks within the mortgage lifecycle.

In conclusion, the strategic adoption of mortgage process automation and the utilization of dedicated mortgage automation services and mortgage process optimization platforms have become imperative in shaping a responsive, efficient, and customer-centric mortgage experience. As technology continues to evolve, the integration of mortgage automation solutions is becoming increasingly integral to the mortgage landscape. Lenders, borrowers, and industry stakeholders stand to benefit from the ongoing advancements in automation technology, ushering in a new era of innovation and effectiveness in mortgage processes.